Published in

PC Hardware

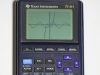

Texas Instruments says chip demand improving

It was better than expected

US chipmaker Texas Instruments has reported a better-than-expected fourth-quarter chip sales. TI said that customers in a broad array of industries replenished depleted inventories and December demand improved throughout January.

TI's clients cut back on stocks of chips around the middle of last year, but began speeding up orders last month because demand from the consumers and businesses that buy their products was not as light as they had feared. Chief Financial Officer Kevin March told Reuters that punters much have reached a point where their inventory numbers were extremely lean.

The company was hiring new workers in some factories this quarter to cope with increasing demand. However it still plans to close older factories in Texas and in Japan in the next 18 months to cut costs. Dispite all that TI's outlook for the current quarter was not very strong due to a drop off in sales in the wireless business it is closing.

TI reported a fourth-quarter profit of $298 million, compared with $942 million a year-ago. Revenue fell to $3.42 billion from $3.53 billion, but above Wall Street's expectations of $3.25 billion. TI had warned December 8 that chip demand was weak, forecasting a revenue of $3.19 billion to $3.33 billion.

But March said that orders started to improve right away after the December warning. Now TI is predicting a first-quarter revenue in a range of $3.02 billion to $3.28 billion. This is weaker than Wall Street expectations for $3.47 billion.

Tagged under