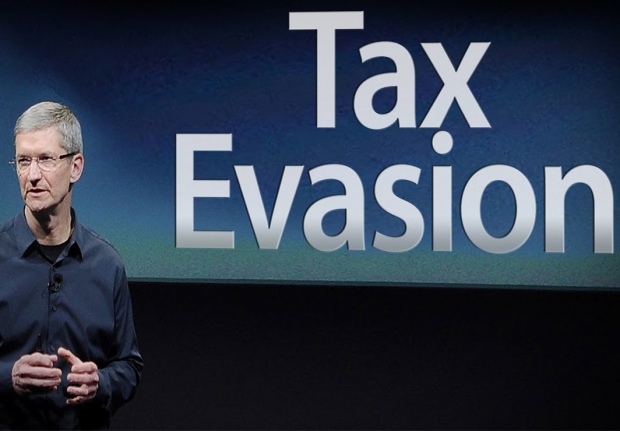

The executive branch of the European Union has ruled that Ireland granted unfair and illegal tax breaks to the tech giant Apple, and the fruity cargo cult now owes more than $14.5 billion in back taxes.

The commissioner in charge of competition policy, Margrethe Vestager, says that under EU rules, "Member states cannot give tax benefits to selected companies."

The commission had been wondering how Jobs’ Mob managed to pay far less in taxes than other companies even when it was set up in Ireland where there is a low corporate tax.

Apple chose to record all sales in the EU as sales in Ireland, allowing that low rate to apply to all sales in the entire EU single market, which is not quite how it works.

The size of the tax break was huge. Normally in Ireland the corporate tax rate is 12.5 percent. That is pretty low, but in 2003, Apple paid Ireland one percent and by 2014, that had dropped to 0.005 percent.

In fact, Apple has been dodging tax through its cosy relationship with the Irish since 1991. But they can order recovery only of "illegal state aid" — which is what the EU considers those tax breaks to be — from 2003 to 2014.

Ireland's finance minister says he "profoundly" disagrees with the decision and plans to appeal. Apple which never admits it did anything wrong ever also promises an appeal. The decision "will have a profound and harmful effect on investment and job creation in Europe".

Not really, because all that money that Apple is currently not paying anyone is just sitting in a bank account not doing anyone any good. If Jobs’ Mob is forced to pay the tax it owes it could go toward education programmes and other things which will help Europe being a happy place with plenty of jobs.