Despite selling its mobile phone business many years ago, Nokia's mobile networks division is no longer as profitable as it was four years ago when Chief Executive Officer Pekka Lundmark took charge to revitalise the business.

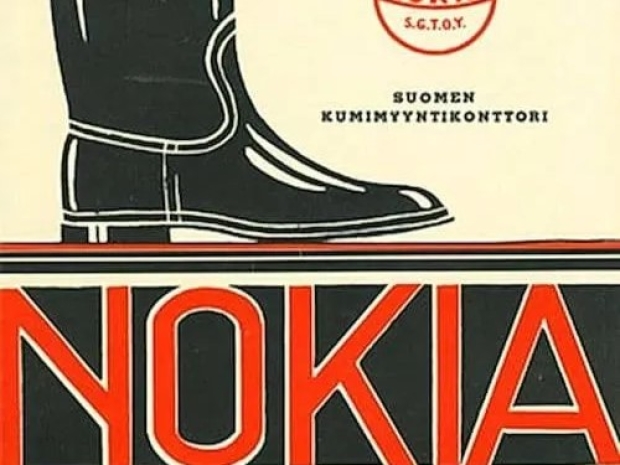

Bloomberg claims that the former rubber boot maker is exploring several options to salvage its mobile network business, including getting rid of it entirely. The company has reportedly discussed various scenarios with advisers, including selling parts or all of the industry, merging with a competitor, or spinning off the division completely.

No decision has been made yet; several market players have expressed interest in acquiring Nokia's mobile network assets. Among these potential buyers is Samsung, which is keen to strengthen its position in the telecom infrastructure sector.

A Nokia spokesperson said Nokia is focused on ensuring that Mobile Networks is positioned to serve its customers by building the best-performing networks, investing in its portfolio, and creating value for Nokia’s shareholders.

Nokia's mobile network assets are valued at approximately $10 billion, a relatively modest sum for a conglomerate like Samsung. However, a Samsung representative declined to comment, which is understandable given that Nokia has not yet made any definitive decisions regarding its mobile networks business.

Although Nokia has achieved some success in deploying 5G infrastructure for various carriers, there has been a recent decline in demand from network operators. This has prompted the Finnish company to seek ways to make its mobile networks business profitable again and new business opportunities that do not heavily rely on building networks for carriers.